What It Really Costs to Hold Vacant Land Each Year

*Please note: this blog post is not meant to be taken as legal advice, this is purely informational.

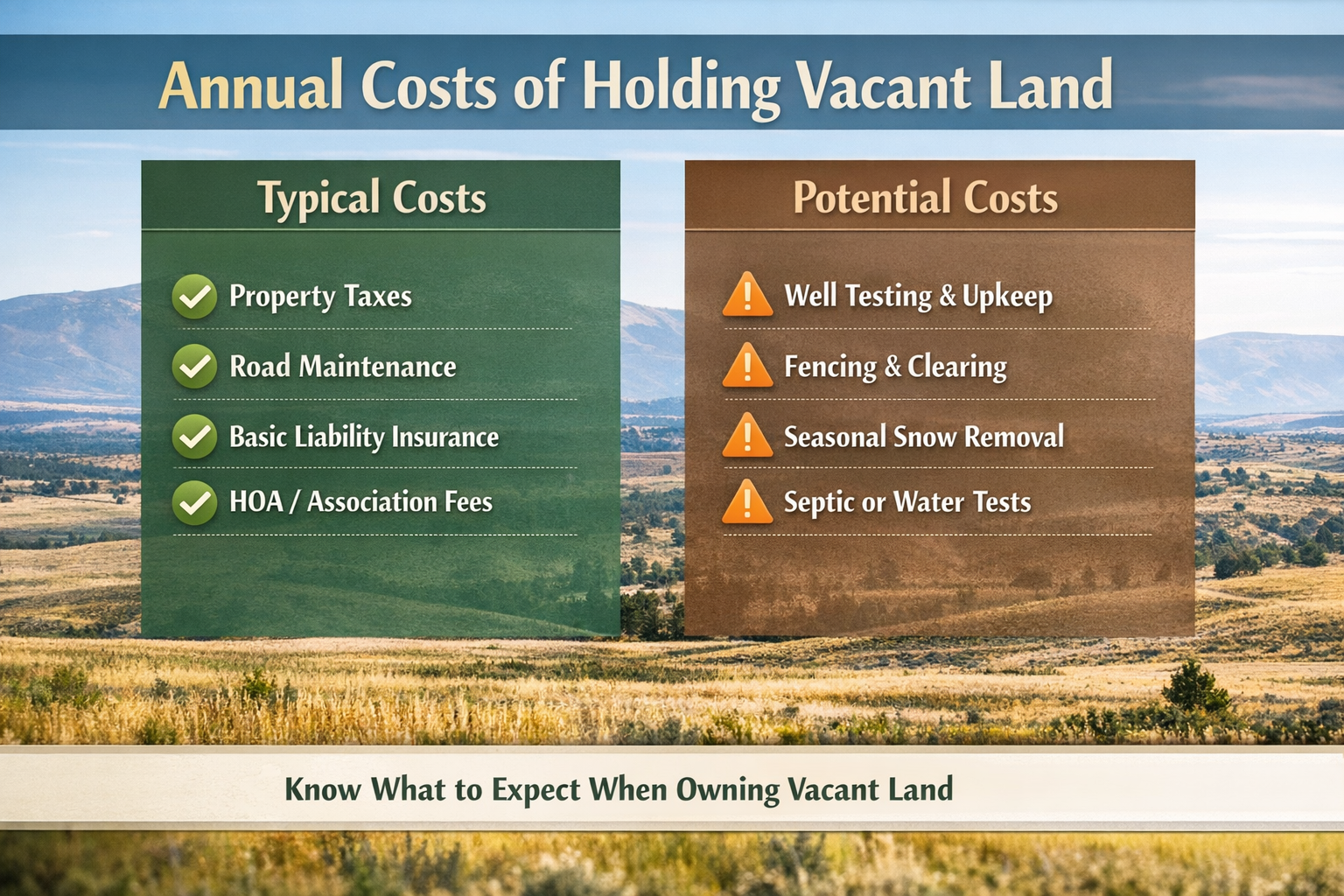

Vacant land is often viewed as a low cost, low stress asset. Compared to homes or rentals, there are fewer moving parts and no structures to maintain. Still, owning land is not free. Understanding the true annual costs of holding vacant land helps buyers plan realistically and avoid surprises.

This breakdown explains the most common expenses landowners face each year, with a focus on rural property in Utah.

Property Taxes

Property taxes are the most consistent annual cost of owning vacant land. In Utah, taxes on raw land are typically lower than residential property, but rates vary by county, zoning, and assessed value.

Factors that influence land taxes include:

Parcel size and location

Agricultural vs residential classification

County assessment schedules

For most rural parcels, annual property taxes are manageable, but they should always be factored into long term holding costs.

Access and Road Maintenance

Some vacant land is accessed by county maintained roads, while other parcels rely on private or unmaintained roads. When access is private, landowners may share responsibility for maintenance.

Possible costs include:

Road grading or repairs

Snow removal in winter months

Informal cost sharing with neighbors

These costs are not always annual, but they can arise depending on weather and use.

Insurance Considerations

Vacant land does not require homeowners insurance, but some owners choose to carry basic liability coverage. This is more common when land is used for recreation, grazing, or storage.

Optional insurance costs depend on:

Intended use

Public access or fencing

Liability risk tolerance

While not required, insurance can offer added peace of mind for certain landowners.

Utilities and Improvements

Many vacant parcels have no utilities connected, which keeps costs low. However, expenses may arise if an owner adds improvements over time.

Examples include:

Well testing or maintenance

Septic evaluations

Fencing or gates

Clearing or grading

These costs are optional and often spread out over several years rather than paid annually.

HOA or Community Fees

Some rural subdivisions include homeowners associations or road associations. These fees help cover shared infrastructure and maintenance.

If applicable, fees may include:

Road upkeep

Common area maintenance

Administrative costs

Buyers should confirm whether any association fees apply before purchasing.

Opportunity Costs

While not a direct bill, opportunity cost is part of land ownership. Capital tied up in land is not available for other investments.

Many landowners accept this tradeoff because land offers:

Low ongoing expenses

Long term holding potential

Flexibility of future use

For those focused on preservation of capital rather than short term income, this balance often makes sense.

Typical Annual Cost Range

For many rural Utah parcels, annual holding costs often include:

Property taxes

Occasional access maintenance

Optional insurance

In many cases, total annual costs remain relatively low compared to improved real estate. Exact amounts vary by parcel, county, and intended use.

Why Buyers Still Choose Vacant Land

Despite these costs, many buyers prefer vacant land because it offers simplicity. There are no tenants, no repairs, and no constant oversight. Ownership costs are predictable, and land can be held long term with minimal involvement.

Understanding the real costs upfront allows buyers to plan confidently and avoid financial strain.

Final Thoughts

Holding vacant land comes with ongoing expenses, but they are often modest and manageable. By understanding property taxes, access responsibilities, and optional costs, landowners can make informed decisions and enjoy the benefits of land ownership without surprises.

For buyers considering rural land in Utah, knowing the true cost of ownership is a key part of long term planning.