What is the 10% Rule in Real Estate?

Understanding the 10% Rule in Real Estate

The 10% Rule in real estate is a quick way to evaluate whether a property is financially worthwhile before diving into complex calculations. It’s a simple formula that states a property’s annual income should equal about 10% of its total purchase price. This means if you buy a property for $200,000, it should ideally bring in $20,000 per year in gross rent or income to qualify as a strong investment.

This rule helps both first-time buyers and experienced investors determine if a property aligns with their goals without needing to run full ROI analyses. It’s often used during the early stages of research to filter through listings and focus on those that make financial sense.

The 10% Rule is particularly valuable because it:

Simplifies decision-making when analyzing multiple properties

Provides a benchmark for what counts as a profitable deal

Prevents overpaying in competitive or inflated markets

Encourages discipline by focusing on return, not emotion

In short, it’s a quick litmus test for property value—one that keeps you grounded in numbers before emotions influence your decisions.

How the 10% Rule in Real Estate Works

To apply the 10% Rule, divide the expected annual rent by the purchase price of the property. If the result equals 0.10 or higher, the property is likely to offer a healthy return. It’s not a guarantee of success, but it’s a solid indicator that the deal is worth investigating further.

For example:

Purchase Price: $180,000

Expected Monthly Rent: $1,500

Annual Rent: $18,000

$18,000 ÷ $180,000 = 0.10 or 10%

When used correctly, this rule saves time and helps investors compare deals side by side. It’s especially useful when touring multiple properties or evaluating listings in fast-moving markets. You can apply it mentally while scrolling through real estate platforms, helping you spot high-performing opportunities quickly.

Beyond rentals, the rule can also be used as a baseline for returns on other asset types, including vacation homes, multifamily units, or even long-term land holds. Investors often modify the percentage based on market risk, urban areas may accept 6–8%, while rural or developing areas might aim for 10–12%.

Why the 10% Rule Matters

Real estate investing often involves balancing emotion, opportunity, and numbers. The 10% Rule matters because it helps maintain that balance by turning complex financial decisions into simple math. It’s easy to get distracted by curb appeal, location hype, or renovation potential, but if the numbers don’t add up, even the prettiest property can become a poor investment.

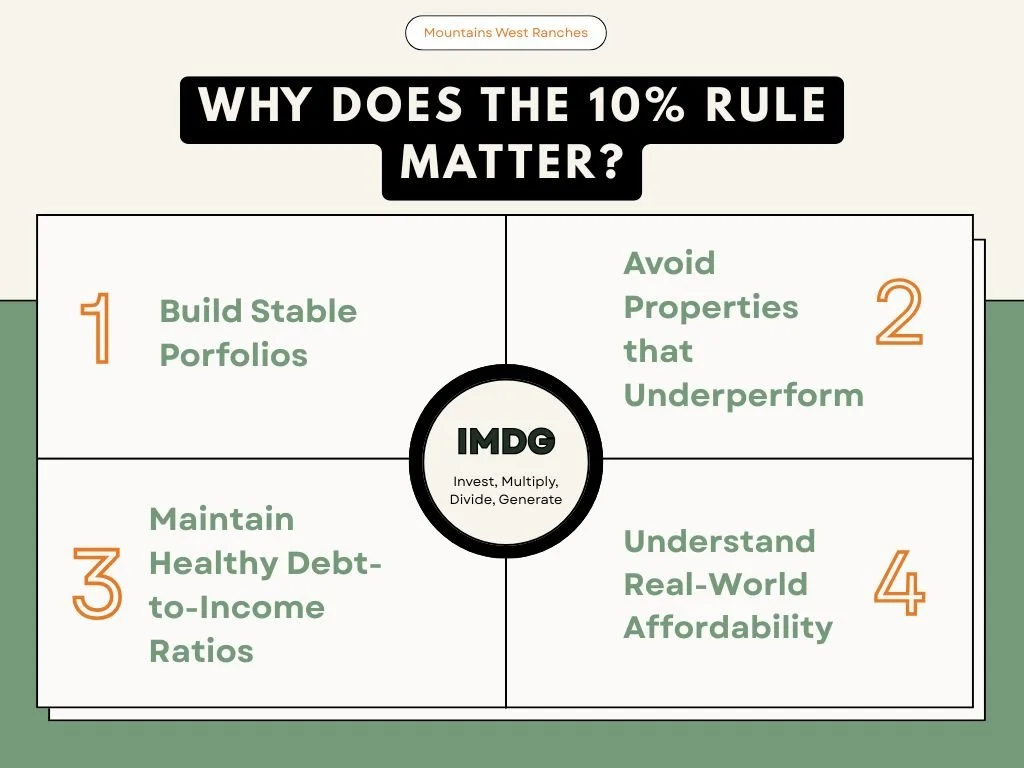

This rule helps you stay focused on financial fundamentals. When used regularly, it creates habits that lead to better long-term decisions. Investors who follow the 10% Rule tend to:

Build stable portfolios focused on sustainable cash flow

Avoid properties that underperform due to high overhead or low rent

Maintain healthy debt-to-income ratios and prevent over-leverage

Understand real-world affordability, not just lender-approved limits

It’s not about chasing perfection, it’s about ensuring that every property you buy has the potential to earn its keep. Whether you’re flipping, holding, or renting, the 10% Rule keeps your decisions profit-driven and realistic.

Limitations of the 10% Rule

While the 10% Rule is simple and effective, it’s not universal. Market conditions, property types, and financing options can make the 10% benchmark harder or easier to achieve. In some high-demand metro areas, even strong investments might fall closer to 6–8%, while in rural markets, 12–15% returns may be possible.

The rule also doesn’t account for net income. It only looks at gross rent, meaning it doesn’t factor in expenses like:

Property taxes and insurance

HOA or management fees

Vacancy periods and repairs

Utility costs or maintenance

These can significantly affect your true return, so the 10% Rule should be seen as an initial screen, not a final verdict. It helps identify promising deals, but the next step is always to calculate the net operating income (NOI) and cash-on-cash return. Investors who understand both levels of analysis tend to make better, more sustainable decisions.

Applying the 10% Rule to Land Investments

The 10% Rule can also apply to land purchases, though in a slightly different way. Since raw land doesn’t generate monthly rental income, investors typically evaluate it based on appreciation potential, resale margins, or leasing opportunities. For example, a 10-acre property purchased for $50,000 that increases in value to $55,000 within a year technically follows the 10% Rule in terms of return.

In Utah, many land investors use this rule to gauge whether a property is worth holding or improving. For instance, if you plan to clear, fence, or subdivide land, the 10% benchmark helps you set resale goals and estimate future value. It also guides pricing for short-term uses like:

RV or cabin leases for weekend travelers

Agricultural rentals for grazing or farming

Recreational use agreements like hunting or ATV access

When applied correctly, the 10% Rule keeps land buyers realistic about timelines and profit margins while still aiming for meaningful appreciation.

When to Adjust the 10% Rule

Not all markets or properties fit neatly into this guideline. Investors often modify the rule depending on risk level and investment type. For example:

Low-risk, urban markets: 6–8% may still be acceptable if appreciation is steady.

Mid-tier suburban areas: 8–10% is a balanced, sustainable range.

High-risk or rural markets: 10–12% helps offset slower appreciation or higher vacancy risk.

Adjusting your expectations based on market behavior keeps your portfolio diversified and protected from unpredictable shifts. The key is consistency, apply the rule with discipline, but adapt it when conditions call for flexibility.

Final Thoughts

The 10% Rule in real estate is a timeless, easy-to-use benchmark that helps investors evaluate potential deals, stay disciplined, and focus on properties that deliver real financial value. It’s not about guessing returns, it’s about creating a structured framework for smarter decisions. By turning big numbers into simple percentages, this rule gives you clarity and confidence whether you’re purchasing rental homes, multifamily units, or open land in Utah.

When combined with full financial analysis, the 10% Rule can help shape a portfolio that’s both profitable and sustainable. Use it as your first filter, if the numbers make sense here, the rest of your due diligence will likely confirm that you’re looking at a solid investment opportunity.

Disclaimer: Mountains West Ranches is not a licensed financial advisor, investment advisor, etc. The information provided on this blog and in any related materials is for informational purposes only and does not constitute financial, investment, legal, or tax advice. We encourage all investors to conduct their own due diligence and consult with a licensed financial advisor or other qualified professional before making any investment decisions.