What is the 7% Rule in Real Estate?

Understanding the 7% Rule in Real Estate

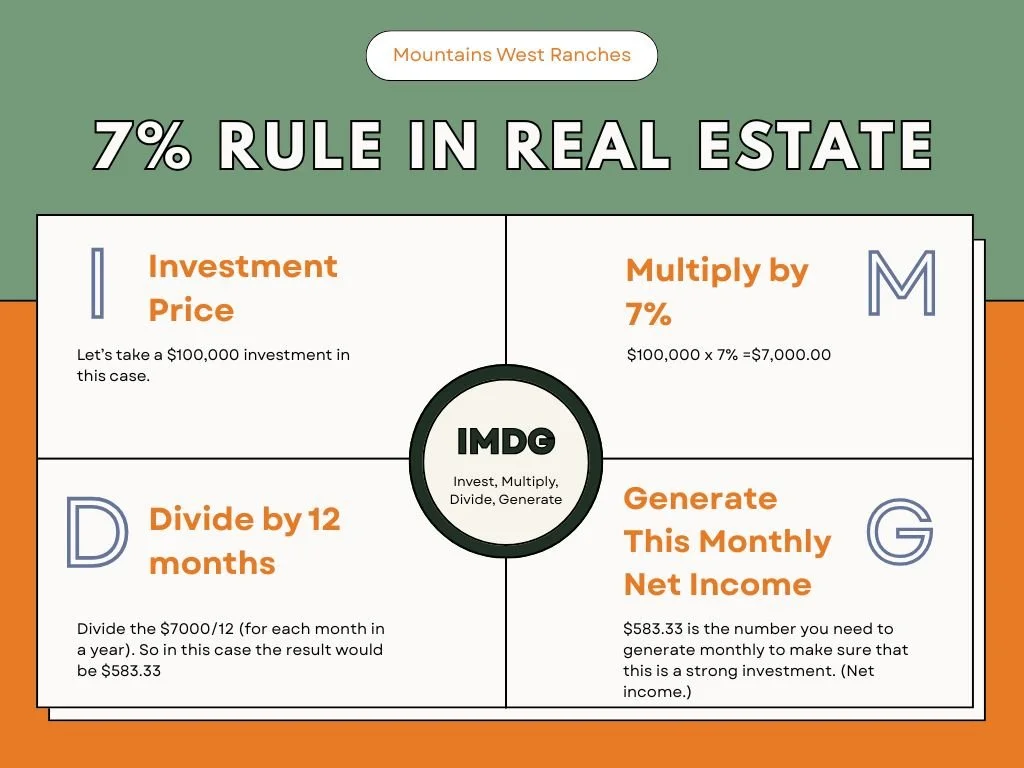

The 7% rule is a general investment guideline often used by real estate investors to estimate whether a property will generate a good return. It suggests that a property should bring in at least 7% of its purchase price in annual net returns to be considered a strong investment.

Example:

If a property costs $100,000, the 7% rule says you should aim to make at least $7,000 a year after expenses.

Here’s the quick breakdown:

7% of $100,000 = $7,000 per year

$7,000 ÷ 12 months = $583.33 per month

So to follow the 7% rule, a $100,000 investment should generate at least $583.33 per month in net income (after expenses) to meet that 7% annual return target.

For land, this can come through appreciation, leasing, or eventual resale, rather than monthly rent like with houses.

For traditional real estate, this often means factoring in rental income, property management, taxes, insurance, and maintenance. For land investments, it can mean evaluating appreciation potential, development opportunities, or future resale value.

How the 7% Rule Applies to Land Investments

Unlike traditional residential or commercial properties, raw land doesn’t generate monthly rent, so investors often think long term. But the 7% rule can still help guide your decision. Instead of rental income, your “return” on land can come from:

Appreciation over time

Reselling at a higher value

Subdividing and selling smaller lots

Leasing for agriculture, solar, or recreation

Adding improvements to increase value

Example:

You buy a parcel of land for $50,000.

Over five years, you sell it for $70,000.

That $20,000 gain equals a 40% return, or roughly 8% per year, exceeding the 7% rule benchmark.

Why the 7% Rule Matters for Future Land Value

When you invest in land, you’re often playing the long game. Even though you may not see immediate cash flow, choosing properties with strong potential for growth could help you meet or surpass the 7% rule over time.

Here’s what to look for:

Location: Areas with growing populations or development nearby

Zoning and utilities: Flexibility for future builds or use

Owner financing: Makes it easier to control land without a large upfront investment

Access and terrain: Land that’s easy to use or develop tends to appreciate faster

This is why rural Utah land could be a strong investment, low entry costs, flexible use, and long-term growth potential make it easier to hit or exceed that 7% target.

Using the 7% Rule to Guide Smart Land Purchases

Even if your land doesn’t bring in immediate cash flow, you can use the 7% rule to compare opportunities.

Ask yourself:

Will this parcel likely appreciate at least 7% annually?

Can I add improvements (like RV pads, fencing, or subdivision) to create value?

Is the location poised for growth or development?

Does the purchase price leave room for profit?

If the answer is yes, you could be positioning yourself for a smart, long-term return.

Land Down the Line: Turning Today’s Purchase Into Tomorrow’s Asset

The biggest advantage of land is its flexibility. Many buyers hold land for several years, then resell or develop when the market strengthens or when they’re ready to build. That’s why applying the 7% rule at the start matters, it keeps your investment goals clear.

Hold and resell as values climb

Lease it for passive income

Build a cabin or RV pad to increase resale value

Subdivide for multiple smaller lots

This approach turns raw land into a strategic investment, not just empty acreage.

FAQ: The 7% Rule and Land Investing

What if my land doesn’t make 7% right away?

That’s okay. Land often takes time to appreciate. Focus on location and long-term potential.

Does the 7% rule apply to recreational land?

Yes, though income may be less direct, recreational land can appreciate steadily, especially near lakes, mountains, or recreation zones.

Can owner-financed land still meet the 7% rule?

Yes. With a low down payment and flexible terms, you can leverage growth over time without heavy upfront costs.

Why This Rule Works for Utah Land Buyers

Utah’s rural land market offers lower entry prices, plenty of outdoor appeal, and long-term growth potential. Many buyers purchase land with the intention of holding it and reselling in the future. When you factor in appreciation, improvements, and low carrying costs, hitting a 7% annual return can be achievable.

Start Building Your Land Investment Strategy Today

If you’re considering buying land with appreciation in mind, the 7% rule gives you a clear target to work toward. Think of your land not just as a piece of property, but as a future asset that could grow in value over time.

👉 Explore available Utah land parcels that could have long-term potential and have flexible owner financing.

Disclaimer: Mountains West Ranches is not a licensed financial advisor, investment advisor, etc. The information provided on this blog and in any related materials is for informational purposes only and does not constitute financial, investment, legal, or tax advice. We encourage all investors to conduct their own due diligence and consult with a licensed financial advisor or other qualified professional before making any investment decisions.