What Is the 1% Rule in Real Estate?

The 1% Rule in real estate is one of the simplest and most widely used methods for evaluating whether a rental property has strong income potential. At its core, the rule states that the monthly rent should be at least 1% of the property’s total purchase price, including any renovation or upfront improvement costs. For example, if you purchase a home for $200,000, the rent should ideally sit at or above $2,000 per month. This guideline helps investors quickly determine whether a property is likely to generate enough income to cover mortgage payments, insurance, taxes, repairs, and property management. It’s a fast screening tool that eliminates time spent analyzing properties that simply cannot produce meaningful cash flow, especially in markets where prices fluctuate or rentals vary widely.

The 1% Rule is popular because it keeps investors focused on performance, not emotions, and it helps new investors avoid falling in love with a property that might be financially weak. It takes the complexity out of evaluating deals and condenses it into a simple, memorable calculation. Some of the biggest advantages of the rule include:

Quickly comparing multiple potential rentals

Estimating cash flow without spreadsheets

Reducing the likelihood of overpaying

Creating a consistent filter for long-term investing

While the rule is not a perfect answer for every market, it offers a solid foundation that keeps your decisions grounded in real financial logic.

How the 1% Rule Works

Using the 1% Rule is straightforward, and that’s why so many investors rely on it during the early stages of property analysis. To apply it, take the total investment amount—which includes the purchase price and any work needed to make the property rent-ready, and multiply it by 1%. The resulting number is the minimum rent the property should produce each month. So if you buy a home for $180,000 but need $20,000 in repairs, your true investment is $200,000. Multiply that number by 0.01, and you get $2,000. If the area’s rental rates are around that level or higher, the property may be worth exploring further.

This rule works well because it incorporates both the cost to acquire the property and the cost to prepare it for rental income, which gives you a more realistic starting point. It also allows for quick comparisons when browsing listings online, walking through potential investments, or reviewing distressed properties that require repairs. The 1% Rule doesn’t replace full due diligence, but it does help investors:

Narrow down neighborhoods and ZIP codes worth investing in

Eliminate rentals that barely break even on paper

Understand how renovation budgets affect rental viability

Make fast decisions in competitive markets

By relying on a percentage instead of emotion, investors gain clarity and avoid deals that look good on the surface but fail to perform financially.

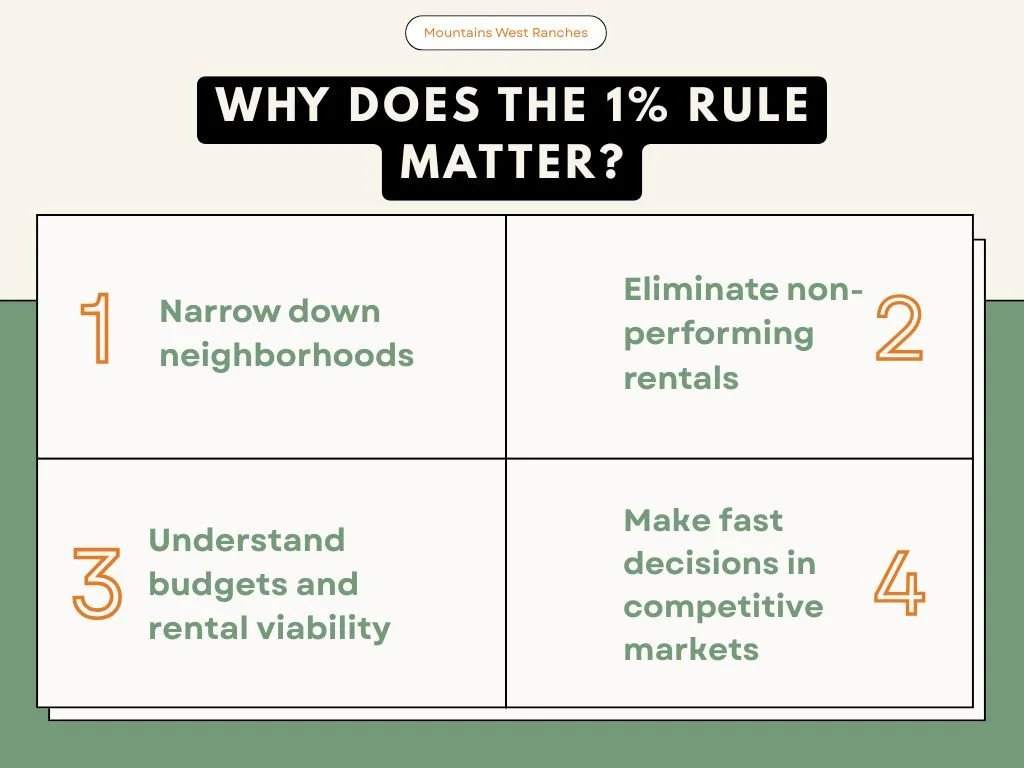

Why the 1% Rule Matters

The significance of the 1% Rule goes beyond quick math, it creates a strong foundation for long-term financial health in your real estate portfolio. Many new investors underestimate the cost of running a rental property, especially when accounting for maintenance, insurance, taxes, vacancies, and unexpected repairs. The 1% Rule helps protect against these risks by ensuring there is enough monthly income before the final purchase decision is made. It guides investors toward properties that produce real cash flow instead of deals that barely break even or, worse, operate at a loss.

The biggest advantage of the 1% Rule is that it helps keep investors disciplined, especially when navigating emotional or competitive markets. Properties that fall far below the 1% threshold often struggle to produce strong returns even if they appreciate over time. Investors who rely on the rule tend to build portfolios that are more resilient, more profitable, and better positioned for long-term stability. It matters because it aligns your investment strategy with cash flow, sustainability, and smart financial planning—not speculation or guesswork.

Limitations of the 1% Rule

Although the 1% Rule is extremely useful, it’s not a universal formula. Every real estate market is different, and some areas simply don’t offer properties that meet the 1% threshold. For example, high-cost metro areas often have property values that rise faster than rental rates, making it difficult for investors to find homes that meet the rule even if the properties appreciate significantly. On the other hand, rural or emerging markets may exceed the 1% expectation but come with higher vacancy risk or slower long-term growth.

Additionally, the rule focuses on gross rent, not net income. Investors still need to consider factors like:

Local property taxes

Insurance premiums

HOA fees

Maintenance and repair costs

Vacancy periods

Property management fees

These expenses can dramatically impact profitability. The 1% Rule is best viewed as a first filter, not a final decision-maker. Once a property passes this initial test, investors should follow up with a full financial analysis that includes NOI, cap rate, and cash-on-cash returns.

Applying the 1% Rule to Land and Rural Properties

While the 1% Rule is traditionally used for rental homes, it can also be adjusted to evaluate raw land, especially in rural areas like Utah where recreational, agricultural, or short-term leases may produce income. Because land typically doesn’t generate monthly rent in the same way houses do, investors apply the rule to lease potential, seasonal income, or projected appreciation. For example, if you buy a $50,000 parcel, you might look for ways to create around $500 a month in value—whether through grazing leases, RV rentals, short-term camping, or future resale gains.

Landowners often use the 1% mindset as a baseline for determining whether their property can become self-sustaining. This helps guide decisions like whether to:

Add improvements such as driveways or clearing

Install utilities for RV or tiny-home use

Lease the land for grazing or agriculture

Open the property to camping or recreation

Even though land functions differently from rentals, the 1% Rule provides a framework for understanding potential income and future value.

When to Adjust the 1% Benchmark

Real estate investing isn’t one-size-fits-all, and the 1% Rule is no exception. Depending on your strategy, risk tolerance, and market conditions, you may adjust the benchmark up or down. Some investors in low-risk suburban markets aim for 0.8%, especially if appreciation is strong. Others who buy in developing or rural areas prefer 1.2% or more, especially when property values are low and rental demand is consistent.

Adjusting the rule helps you stay flexible while still maintaining a consistent investment framework. Investors who understand when to adapt the percentage tend to make decisions that better align with their goals, whether those goals involve stable cash flow, higher returns, or long-term equity growth.

Final Thoughts

The 1% Rule in real estate remains one of the most practical and reliable tools for screening potential rental investments. It gives investors a fast, confidence-building way to filter out poor-performing properties and focus on opportunities with real cash flow potential. While it shouldn’t replace full financial analysis, it’s an essential first step in evaluating whether a deal is worth pursuing.

Whether you’re exploring rental properties, evaluating a multifamily unit, or adapting the rule to a piece of undeveloped land, this guideline helps you make smarter, more strategic choices. By keeping your decisions grounded in numbers, not emotions, the 1% rule can help you build a profitable, sustainable portfolio that grows over time.

Disclaimer: Mountains West Ranches is not a licensed financial advisor, investment advisor, etc. The information provided on this blog and in any related materials is for informational purposes only and does not constitute financial, investment, legal, or tax advice. We encourage all investors to conduct their own due diligence and consult with a licensed financial advisor or other qualified professional before making any investment decisions.