Property Taxes on Utah Land: What to Expect

Please note: this blog is meant to be purely informational and not meant to be taken as advice.

If you're looking to buy land in Utah, understanding how property taxes work is an important part of planning your budget. Unlike residential or commercial real estate, raw land in Utah often comes with very low annual taxes, especially when it’s located in rural areas and used for recreational or agricultural purposes.

In this guide, we’ll explain how property taxes are calculated, how much you can expect to pay, and what programs—like Greenbelt—can reduce your tax burden even further.

How Property Taxes Work in Utah

In Utah, property taxes are based on the assessed value of the land, which is set annually by the local county assessor. The assessor determines a “market value” for your parcel, then multiplies that value by a local mill levy (tax rate) to calculate how much you owe.

Your final tax bill is influenced by:

The county your land is in

The size and zoning of the parcel

Whether utilities or structures are present

Special tax districts (fire, school, water)

Any exemptions or agricultural classifications

Unlike residential properties, raw land typically doesn't include buildings, improvements, or infrastructure—so its assessed value stays low.

How Much Are Property Taxes on Raw Land in Utah?

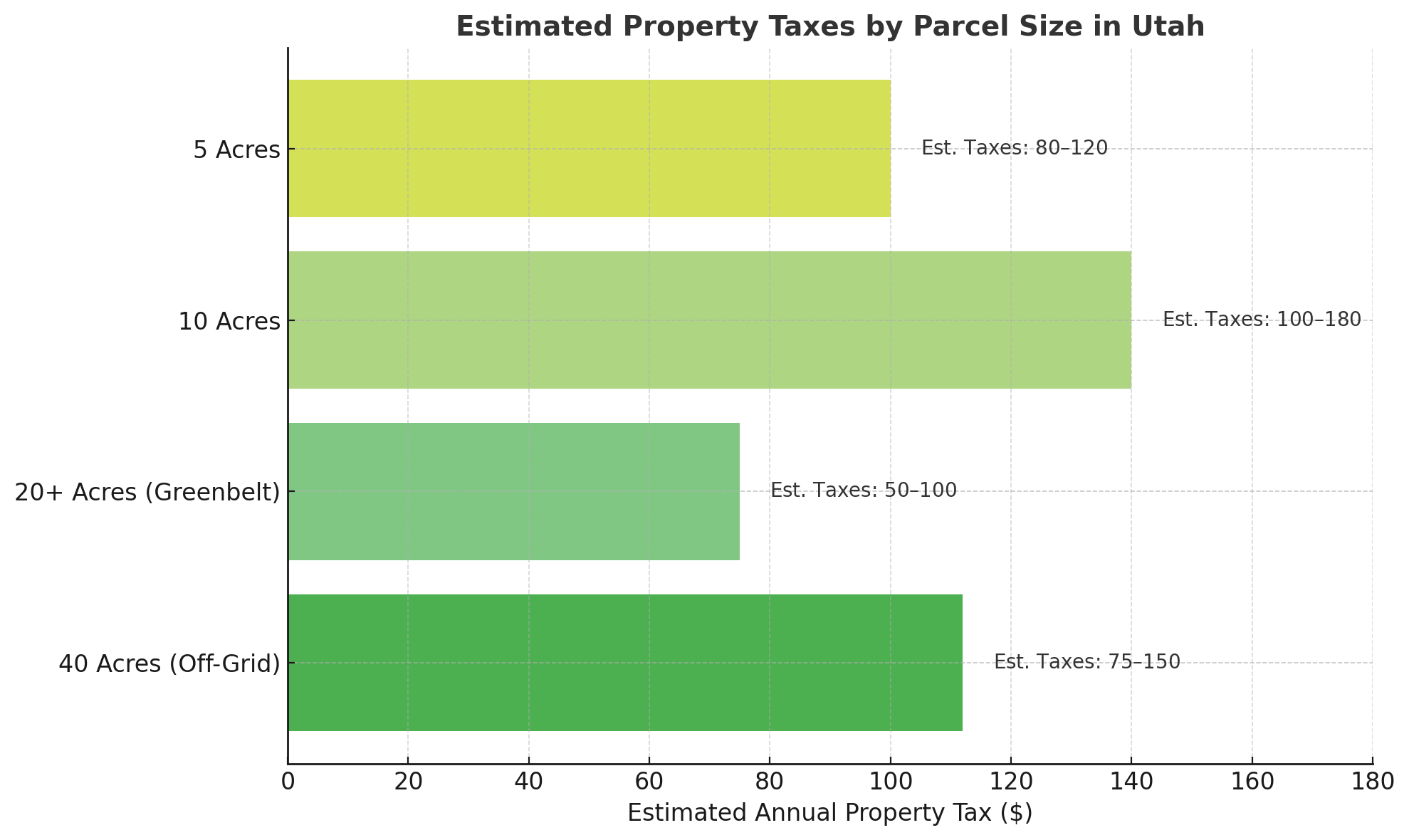

5-Acre Parcels – Raw Recreational Use

Estimated annual property taxes: $80–$120

Typically undeveloped land used for camping, off-grid access, or weekend recreation

10-Acre Parcels – Undeveloped Land

Estimated annual property taxes: $100–$180

May include basic access roads or clearing, but no utilities or structures

20+ Acre Parcels – Agricultural Use (Greenbelt Eligible)

Estimated annual property taxes: $50–$100

Land is used for grazing, hay production, or small-scale farming

Tax savings apply when enrolled in the Greenbelt Program

40-Acre Parcels – Off-Grid Ranchland

Estimated annual property taxes: $75–$150 (or lower with Greenbelt)

Large, rural tracts ideal for long-term investment or agricultural use

Greenbelt Program: Save More on Land Taxes

Utah’s Farmland Assessment Act, commonly known as the Greenbelt Program, offers tax reductions for land that is used for agricultural purposes. This program is especially useful for buyers who plan to graze animals, grow hay, or use land for low-impact farming.

Basic Greenbelt Requirements:

The land must be actively used for agriculture (grazing, crops, etc.)

Minimum of 5 acres (not including homesites or buildings)

Must be approved by the local county assessor

Requires periodic documentation or renewal

When approved, your land is taxed on its agricultural productivity value, not its market value—often reducing the tax bill by 80–90%.

This program is ideal for long-term landowners who want to save on taxes while maintaining flexibility for future use.

Learn more about Greenbelt eligibility →

When and How to Pay Property Taxes

Here’s how the tax cycle typically works for landowners in Utah:

Assessed values are updated annually by the county assessor

Tax notices are mailed in October of each year

Property taxes are due by November 30

Payments can be made online, by mail, or in person

Late payments may result in interest or penalties

If you're financing land through Mountains West Ranches, you'll still be responsible for the property taxes each year—but since raw land taxes are typically low, most owners find them easy to manage.

Other Factors That May Affect Your Tax Bill

Although land is usually taxed lower than developed properties, here are a few scenarios that could affect the amount you owe:

Adding a structure (even a shed or cabin) may raise assessed value

Installing utilities (like a well or power) could trigger revaluation

Changing zoning or parcel use may impact your eligibility for Greenbelt

Subdividing land may create multiple tax parcels with separate bills

It’s a good idea to consult with the county assessor’s office if you’re planning any major changes to your property. This can help you avoid unexpected increases.

Why Utah Land Is a Low-Cost Long-Term Asset

One of the biggest benefits of owning land in Utah is that there are very few carrying costs. You won’t have monthly bills for utilities, mortgage insurance, or HOA fees. And because rural land values are assessed conservatively, your tax burden remains low—even for large properties.

This makes raw land a smart choice for:

Investors looking to hold property long-term

Buyers who want to use land for camping or recreation

Homesteaders or off-grid living enthusiasts

Families buying now to build later

Explore available land for sale in Utah →

Final Thoughts on Land Property Taxes in Utah

Buying land doesn’t come with the same costs or tax structure as owning a home or rental property. In Utah, most raw landowners pay a fraction of what residential owners pay, even for parcels over 10 acres. When combined with optional tax programs like Greenbelt, your annual tax cost can be incredibly low.

At Mountains West Ranches, we help you understand what to expect before you buy—so there are no surprises down the road.

If you’re considering land ownership in Utah, reach out to our team for help finding the right lot and understanding the full cost to own.

Contact us here to get started.